Supreme Court Again Amends Preservation Requirements of Rehearing Rule

Rule 1.530 and 12.530 require rehearing motions to challenge the failure to make required findings of fact -- but how do you navigate the rule to ensure preservation when the findings are in non-final orders?

Rule Change: Rehearing Required to Preserve Challenge to Sufficiency of Trial Court Findings

The Florida Supreme Court Friday amended Florida Rule of Civil Procedure 1.530 and Florida Family Law Rules of Civil Procedure 12.530 to expressly require that "To preserve for appeal a challenge to the sufficiency of a trial court's findings in the final judgment, a party must raise that issue in a motion for rehearing under this rule," effective immediately.

Renamed Rules of General Practice and Judicial Administration

The Florida Supreme Court has amended and renamed what was formerly…

What Do I Do if the Other Side Files a Writ of Certiorari, Prohibition, or Mandamus in Florida Cases?

Writs of Certiorari, Writs of Mandamus, and Writs of Prohibition are three different ways a party in Florida state court litigation can seek appellate court intervention even though the judge has not made a final decision. If the other side seeks one of these writs from the appellate court, what do you need to do to protect yourself?

What Are Costs on Appeal in Federal Court?

When the Eleventh Circuit Court of Appeal decides an appeal, the case is not quite over....[T]he winning party should also be ready to deal with filing a bill of costs. What are those costs and when are they owed?

What is a Writ of Certiorari in Florida State Courts?

To bring a Writ of Certiorari, the order must be otherwise unappealable, and the party must demonstrate that harm caused by the order is irreparable and cannot be remedied on plenary appeal, and that the ruling was "a departure from the essential requirements of law."

Fees on Fees Rejected by Third District

Even when you win an award of entitlement to attorney's fees, you may not be entitled to recover fees for the time spent litigating the amount of that attorney's fee award.

Florida Supreme Court Hurricane Dorian Orders

The Florida Supreme Court issued orders retroactively extending deadlines in four of the five Florida District Courts of Appeal due to Hurricane Dorian.

Podcasts & PCAs

Check out Dineen Pashoukos Wasylik's appearance on the Issues on Appeal Podcast, Episode 13 Evaluating a PCA.

How Does a Hurricane Affect Court Deadlines? (Dorian Edition)

In Florida state courts, you won't know until the storm is over, so don't count on a deadline moving. And in Federal Court, the courthouse being closed does not mean you can't file, so your best bet is to meet any deadline today.

Weird, Wild Stuff: Nine Proposed Appellate Rule Changes You May Want to Weigh In On

Don't miss your chance to comment on nine proposed amendments to the Florida Rules of Appellate Procedure.

Is Memorial Day, May 27, a Court Holiday? (2019 edition)

Memorial Day--May 27, 2019--is a day that we remember and…

You Used Daubert at Trial but Now it’s Frye? Here’s What the Appellate Court Might Do. (UPDATED–IT’S DAUBERT AGAIN!)

The Florida Supreme Court declared the statutory revision to section 90.702 unconstitutional, thereby reaffirming that Frye is the test to apply in Florida. Delisle v. Crane Co., 258 So. 3d 1219, 1229 (Fla. 2018). Where does that leave us?

What’s it like to appear before the United States Supreme Court? Let’s talk about it, podcast-style.

The United States Supreme Court hears oral argument from attorneys…

Is Good Friday a Court Holiday? (2019 Edition)

West front of the Church of Notre DameDrawn by A. Pugin ; engraved…

Briefing Deadlines Fixed

A fourth order making rule changes effective January 1, 2019 corrected an oversight and brought brief deadlines in cross-appeals and dependency and parental rights termination cases in line with the rest of the rule changes.

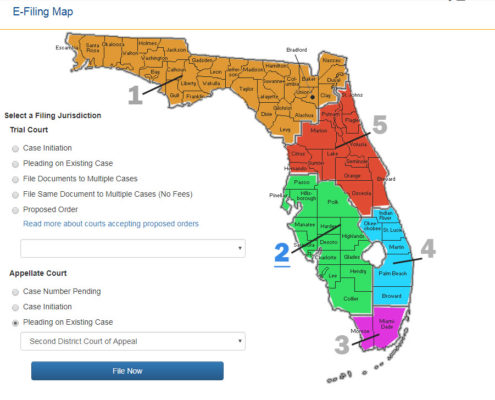

First and Third DCAs Transition to ePortal for Electronic Filing

The First and Third District Courts of Appeal will transition to the ePortal on February 11, 2019.

New Rule 9.380 Allows Notification of Related Cases

New Rule 9.380 allows parties, without argument, to inform an appellate court of "related case or issue" that is either "arising out of the same proceeding in the lower tribunal," or, helpfully, "involving a similar issue of law."

4th and 5th DCAs Transition to Portal

After hours last night, the 4th and 5th DCAs both transitioned to e-portal filing.

Calculating Deadlines Under the New Rules

Don't let January's rule changes cause you confusion! We'll talk you through how the changes to the rules affect calculating deadlines.

Interesting links

Here are some interesting links for you! Enjoy your stay :)Pages

Categories

- Administrative Orders

- Amici

- Appealability

- Appeals 101

- Attorney's Fees and Costs

- Bar Activities

- Bar Governance

- Briefs

- Citations and Style

- Civil Appeals

- Criminal Appeals

- Dicta

- Electronic Filing and Service

- Eleventh Circuit

- Eleventh Circuit Rules

- Error

- Evidence

- Extraordinary Writs

- Family Law Appeals

- Family Law Appeals

- Federal Circuit

- Federal Rules

- Federal Rules of Appellate Procedure

- Federal Rules of Civil Procedure

- Final Orders

- Florida Appellate Procedure

- Florida Constitution

- Florida Family Law Rules of Procedure

- Florida Rules of Appellate Procedure

- Florida Rules of Civil Procedure

- Florida Rules of Criminal Procedure

- Florida Rules of Judicial Administration

- Florida Small Claims Rules

- Florida Supreme Court

- Florida's Fifth DCA

- Florida's First DCA

- Florida's Fourth DCA

- Florida's Second DCA

- Florida's Third DCA

- In the News

- Intellectual Property

- iPad for Appellate Advocacy

- Judges and Justices

- Jurisdiction

- Jury Instructions

- Jury Trials

- Just for Fun

- Mandate

- Mootness

- Motions Practice

- Notice of Appeal

- Oral Argument

- Original Jurisdiction

- Preservation

- Pro Bono

- Quoted

- Record on Appeal

- Rehearing and Reconsideration

- Rendition

- Reviewable Non-Final Orders

- Rule Changes

- Sanctions

- SCOTUS

- Standards of Review

- Statutory Intepretation

- Summary Judgment

- Summary Judgment

- Time

- UCCJEA

- Writ of Certiorari

- Writ of Prohibition

- Writs and Petitions